Energy: It’s valuable, political, and a necessity for modern civilization. As an investment, it’s volatile and risky, even with a generous dividend. And I think it very well could be the next hot investing sector much like the tech sector was over the last decade.

+The time is now

Something happens when a resource gets strained: it demands attention. That attention brings great minds together to make improvements often well beyond the initial baseline. While I wait for attention to come to traffic lights so I’m not waiting two minutes, engine idling, for nobody, I think attention is coming to energy today.

Western countries have been at the mercy of Eastern countries for energy for decades. Although Western countries have always had cultural disagreements with Eastern countries, the reckless Russian invasion in Ukraine might be the start to a breaking point. Now, the West not only wants to produce its own power, it needs to, and great minds are coming together to make it happen. The fusion energy breakthrough that occurred a few weeks ago is a milestone of that progress. These are signs of investment opportunity.

+Governments are effectively subsidizing energy

Government investment is a powerful catalyst and often causes spikes in valuation. The 2008 housing bubble is a prime example, even if that bubble popped, along with the sports industry and tech industry. Energy production continues to be one of the most subsidized industries in the United States, and that certainly helps energy companies boost profits. Another plus for investing.

+Energy is undervalued

Out of all the sectors, energy appears to be the most undervalued right now when applying regression. I like to use regression to determine valuation because of the Law of Averages, which holds true the longer the term. For those who don’t know, the Law of Averages states that most future events are likely to balance any past deviation from the average. I’m a big fan of using the Law of Averages to plan long term moves and will likely talk about it frequently in this journal. We can use regression to calculate the average level of an investment.

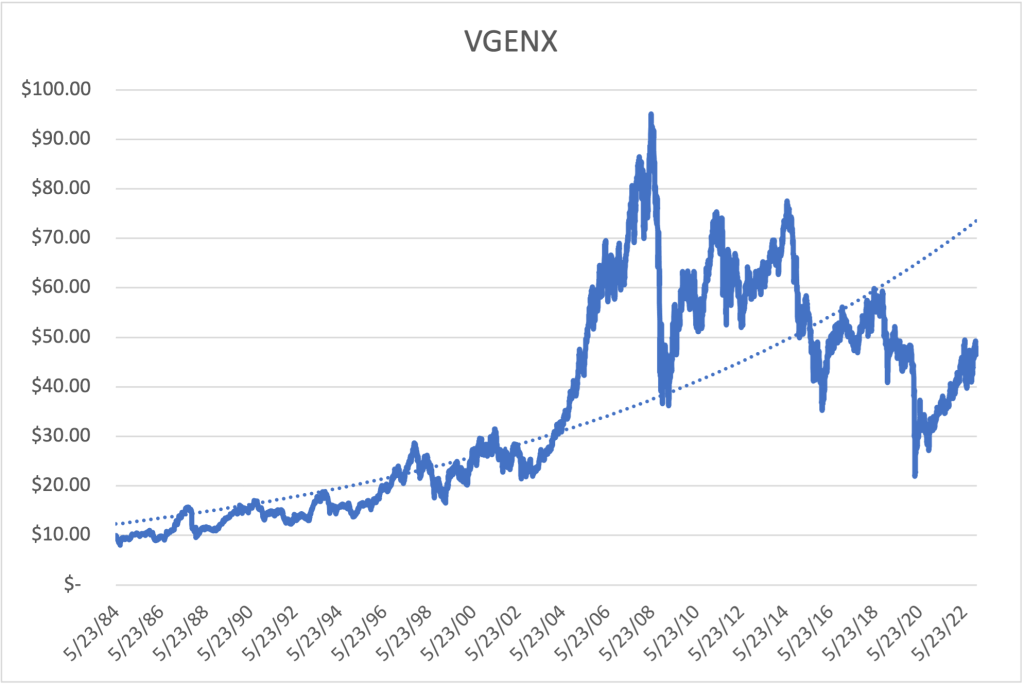

As with most phenomenons, the more data we have, the more precise our forecasting can be. The oldest energy sector fund I could find is Vanguard Energy Fund Investor Shares, VGENX, which has 38 years of data.

The VGENX chart implies the energy sector is below its average, or undervalued. This chart also begs the question, how was the energy sector relatively tame for VGENX’s first 20 years and then become extremely volatile the next 18 years? Did the supply and demand of oil go berserk? According to the International Energy Agency, not quite (see for yourself, https://www.iea.org/data-and-statistics/charts/world-oil-supply-and-demand-1971-2020). If you have any ideas, please share them in a comment below.

+Pessimism breeds investment opportunity

Major investment opportunity exists when optimists beat out pessimists. Most people would think you were crazy if you invested in the retail industry over the last decade. As it continues today, retail stores left and right are closing along with malls, their theme parks. People argue Amazon is monopolizing the entire industry. However, the retail sector has performed extraordinarily well since The Great Recession, only beaten by tech. Another example: the pessimism Tesla faced in 2019 helped a few lucky investors ride the stock to sky-high prices.

Right now, there is plenty of investor pessimism about the energy sector. The Russian war on Ukraine casts uncertainty, governments are moving to alternative sources of energy (which is great, but the current largest energy companies are still fossil fuel companies), and the looming recession might destroy the desire to travel. Covid is unfortunately still thriving and threatens to shut down countries, especially China, which quell travel.

I don’t think these concerns are valid, meaning there’s opportunity. Someone could argue that the actual opportunity is in renewable/alternative energy, but that’s beyond the scope of this post.

Investing in the energy sector could be a valuable addition to a well-diversified portfolio in the forthcoming years.

Leave a comment