I happen to know someone who right now is trying to answer this famous question: should I spend thousands of dollars to repair my old car, or sell it and get a new car?

Many people think, “Well if my car is worth $5k, I wouldn’t bother spending more than 50% of that value in repairs.” And I understand that mindset: if my broken car is only worth $5k, why would I want to cough up the money for a $3k repair? That would only net me $2k in profit if I decided to sell it afterwards, and I could’ve spent that $3k on the downpayment for a new car instead of fixing my old car.

However, this is the wrong way to think about it.

The starting principle is sound: we should use some form of math to determine whether it’s a good idea to repair or sell the car, and 50% of the car’s value is a reasonable metric. However, there’s one small problem with this specific formula: we’re incorrectly basing our decision on the current car’s value, not its replacement cost.

This important distinction comes down to opportunity cost: what you miss out from the second-best decision in order to go with the best decision. Lingo aside, let’s say the replacement cost of that $5k car is $20k ($25k total new car price, not forgetting taxes, registration, and other purchasing costs, minus $5k trade-in of the old car), because of course we would want to buy a brand-new car that will (allegedly) be problem-free for a while. Instead of comparing that $3k repair cost to the current car’s $5k value, we should be comparing it to the $20k cost of a new car. Isn’t spending $3k sound much better than spending $20k? (That’s practically an 85% discount!)

So, here’s what the rule should be: when repair costs exceed 50% of the car’s replacement cost, then sell the old car and get a new one. In the example above, if total repair costs exceeded $10k, then surely get a new car.

+What if you really, really want a new car?

I know what you’re thinking now: that essentially means I’ll never be able to get rid of my old car! For the most part, yes, I would advise holding on to your old car much longer than most people would. Holding on to your car is better for your wallet (more money for other things) and, in most cases, the environment. But if you hate your car or want a new one, there’s still a way to correctly make an analytical decision.

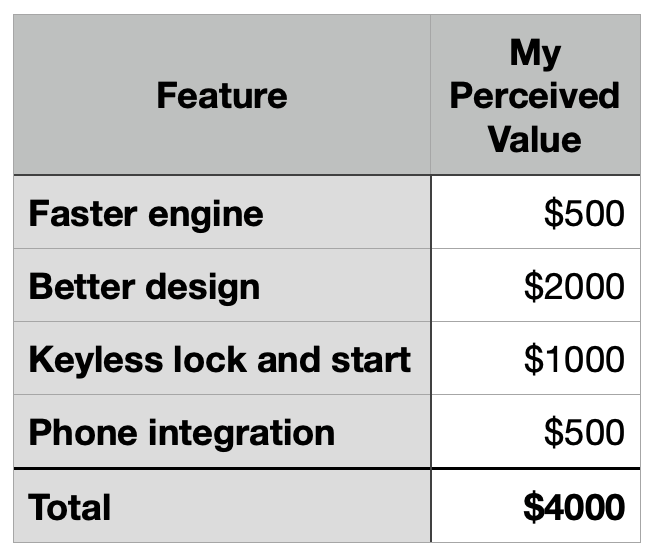

Needs change and newer cars have better features. For example, we might want a bigger car to comfortably haul a new family, or want keyless entry to be able to use a car without having to take a key out of our pockets. What we can do is add the perceived value of newer features we want to the repair cost, and then check to see if we tip that 50% threshold. To continue with the example above, while the car in need of a $3k repair is in the shop, we might check out the new models and notice all the cool, new features: faster engines, better designs, keyless lock and start, phone integration, and more. Now, this part is going to be highly subjective, but here are the values I perceive from these new features (or, in other words, how much I’d be willing to pay for these features):

$3k repair cost + $4k new features adjustment = $7k, still a bit lower than that 50% threshold for that new car. We should hold on to that old car.

+What if I have a really expensive repair down the road?

This part is where things can get complicated, but in spirit of providing a full answer, I’ll include this additional condition to the formula: when current and amortized repair costs plus new car features value exceed 50% of the replacement cost, then replace the car. Let’s say the transmission on our car doesn’t work well and will probably need to be fully replaced in about 2 years—ouch! That’s going to cost $4k for our car!

We can’t just add that $4k to our equation above, because $4k isn’t a current cost. What we should do is amortize that cost across the life of the transmission. Let’s say our car is at 175k miles and the estimated life of the transmission is 200k miles. The amortized cost of the transmission repair is currently $3.5k (175k miles / 200k miles * $4k total replacement cost). Now we have $3k current repair costs + $3.5k amortized future repair costs + $4k new features adjustment = $10.5k. Let’s ditch the car and get a new one!

Conclusion

I understand that most people aren’t going to go through this much analysis and math to make this decision. At the end of the day, if someone wants a new car, and they have the money, they’re just going to get a new car. But for those contemplating, hopefully this helps make an objective decision.

If there’s just one takeaway to take from this post, just remember that when deciding whether to repair or replace a car, consider the replacement cost instead of the car’s current value.

Leave a comment